Reviews

M.R.P.: ₹ 354.00

(Inclusive of all taxes)

Details

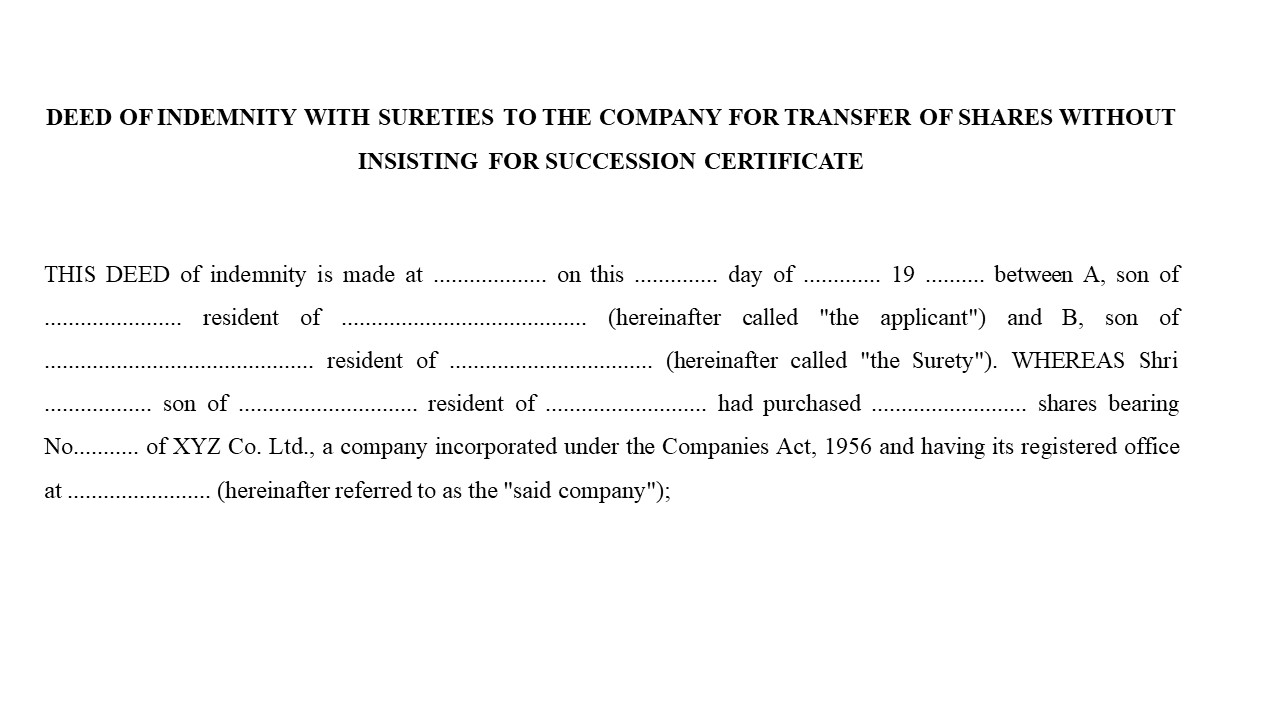

- DEED OF INDEMNITY WITH SURETIES TO THE COMPANY FOR TRANSFER OF SHARES WITHOUT SUCCESSION CERTIFICATE

Description

DEED OF INDEMNITY WITH SURETIES TO THE COMPANY FOR TRANSFER OF SHARES WITHOUT SUCCESSION CERTIFICATE

This is a "Readymade Format for Deed of Indemnity with Sureties to the Company for Transfer of Shares without Succession Certificate ".

Legally required caluses are already in agreement Format in addition to, if is required, then you can add or remove the conditions.

A Deed of Indemnity with Sureties is a legal document that is used when a person wants to transfer shares in a company without a Succession Certificate. A Succession Certificate is a legal document that is usually required when shares are transferred to a person who has inherited them from a deceased person.

The Deed of Indemnity is a legally binding document that is signed by the person transferring the shares (the indemnitor) and one or more sureties (persons who guarantee the indemnitor's obligations). The document outlines the terms and conditions of the indemnity, including the specific shares that are being transferred, the parties involved in the transfer, and the obligations of the indemnitor and sureties.

The Deed of Indemnity typically includes a provision where the indemnitor and sureties agree to indemnify (compensate) the company against any loss or damage that may arise as a result of the transfer of shares without a Succession Certificate.

The Deed of Indemnity with Sureties is an important document for the company as it protects the company against any potential legal or financial issues that may arise from the transfer of shares without a Succession Certificate, and is usually executed and signed by the indemnitor and sureties.

Deed of Indemnity, Sureties, Company, Transfer of Shares, Succession Certificate, Legal Document, Indemnitor, Obligations, Share Transfer, Loss, Damage, Indemnify, Compensation, Execution, Signing.