Reviews

M.R.P.: ₹ 354.00

(Inclusive of all taxes)

Details

- GIFT DEED OF IMMOVABLE PROPERTY

Description

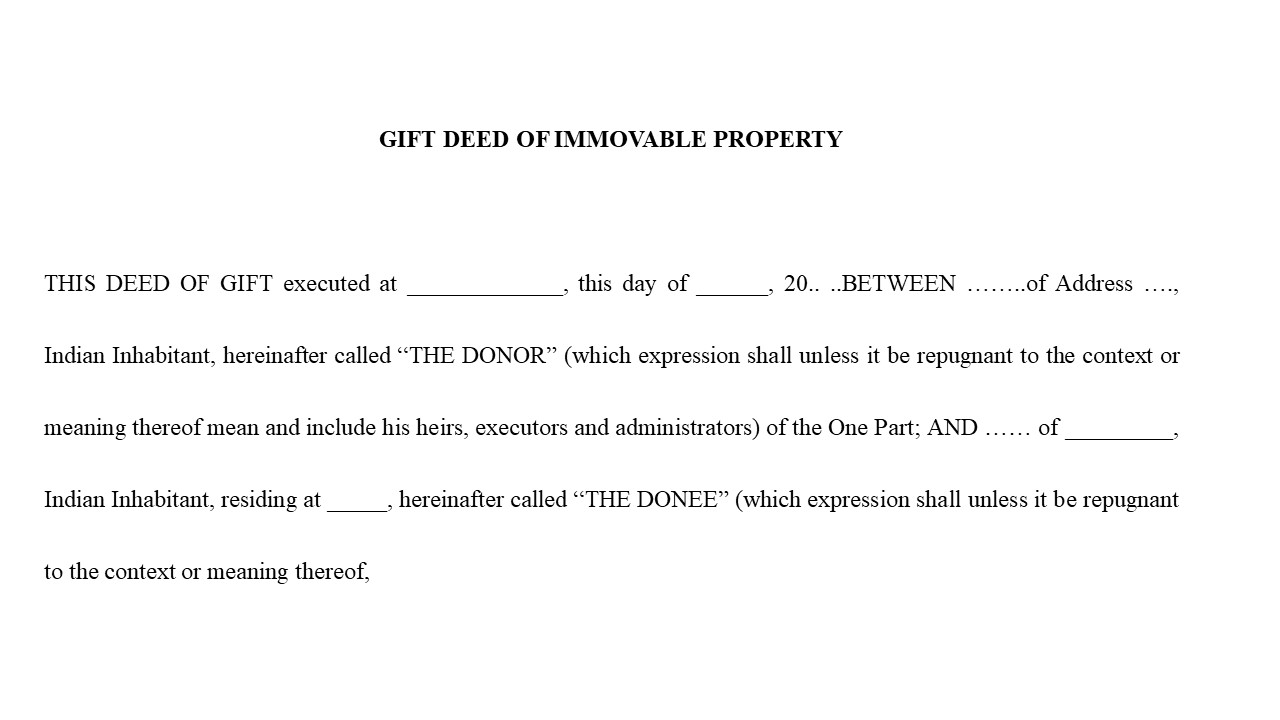

GIFT DEED OF IMMOVABLE PROPERTY

This is a "Readymade Format for GIFT DEED OF IMMOVABLE PROPERTY ".

Legally required caluses are already in agreement Format in addition to, if is required, then you can add or remove the conditions.

A Gift Deed of Immovable Property is a legal document that is used to transfer ownership of a piece of real estate from one person (the donor) to another person (the donee) as a gift. The gift deed should be in writing and should be signed by both the donor and the donee. It should also be registered with the appropriate government authority. This type of gift deed is typically used to transfer ownership of a property as a gift for a specific purpose, such as for family members or for charitable purposes.

"Gift Deed", "Immovable Property", "Real Estate", "Legal Document", "Transfer Ownership", "Donor", "Donee", "Writing", "Signed", "Registered", "Government Authority", "Specific Purpose", "Family Members", "Charitable Purposes".

Know More >>

What is a Gift deed for an immutable property?

A gift deed form is a legal document that allows the original owner of the immutable property to transfer the property to another person as a gift. This document helps in avoiding any raised dispute because of the inheritance claims. There is no monetary exchange exists in the gift deed format for immovable property.

The property owner can hand over the property to a person or an institution for a lifetime. You can download gift deed format from the legal sites and when it is in use to gift a property to someone it should be registered with the sub-registrar under Section 122 of the Property Transfer Act, 1882. In this gift deed along with the gift deed form, details of the transferor and the recipient must be included.

What is the eligibility of gift deed format in word or pdf?

For every successful legal deed, there is a specific eligibility criteria so as with the gift deed. According to the law, in a gift deed format for immovable property a donor of the property should not be a minor. In contrast, the recipient of the property can be a minor with a natural guardian as a nominee. Moreover, the recipient should be alive; otherwise, the gifted property will become invalid.

Learn More >>

What details must be included in the gift deed form?

A gift deed format for immovable property pdf must include the following details:

- Date and place where the gift deed is documented

- Complete details of the Donor including name, father’s name date of birth and donor's address

- Details of the recipient including name, father’s name, DOB and relationship with the Donor

- Explanation of the property to be gifted

- Signatures of both- the donor and the recipient

- An Id proof, PAN card and Aadhaar card of both parties

- Details and signatures of two witnesses present at the time of the formation of the gift deed form

How to make use of the gift deed form for transferring property?

The process to use the gift deed format for immovable property pdf are:

- Draft a gift deed form

This is a document that is prepared with the assistance of an attorney and contains details significant to the property transfer. This transfer must be voluntary and should not be a forceful act.

- Acceptance of the gift deed form

The process of gift acceptance is completed only when the recipient receives the gift property while the donor is alive.

- Registration

The gift deed can only take place for a registered property. A minimum of two witnesses are required to attest to the gift deed form.