Reviews

M.R.P. : ₹ 254.88

(Inclusive of all taxes)

Details

- Loan Agreement

Description

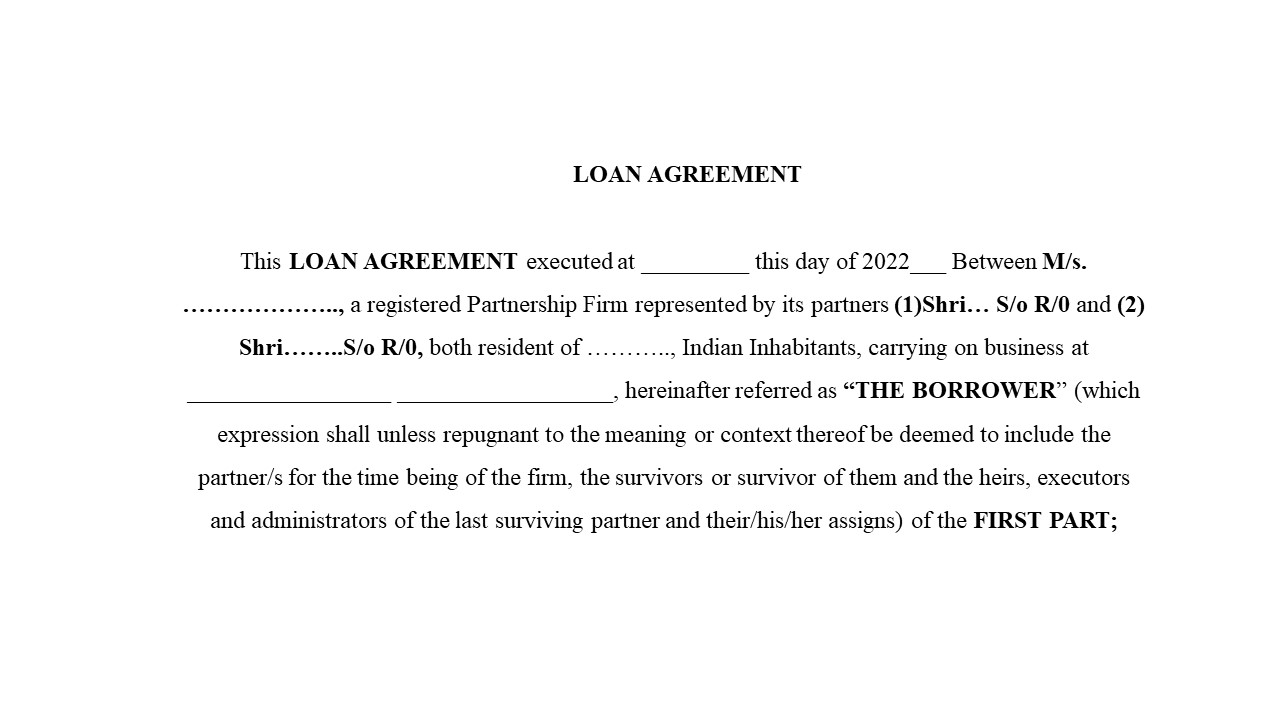

Loan Agreement

This is a "Readymade Format for Loan Agreement ".

Legally required caluses are already in agreement Format in addition to, if is required, then you can add or remove the conditions.

A Loan Agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a loan. It specifies the amount of the loan, the interest rate, the repayment schedule, and any fees or charges associated with the loan. The loan agreement also includes information about the borrower's obligations and the lender's rights in the event of default or delinquency. It also contains information about collateral, if any, that will be used to secure the loan.

loan, agreement, legally binding contract, lender, borrower, terms and conditions, loan amount, interest rate, repayment schedule, fees, charges, borrower's obligations, lender's rights, default, delinquency, collateral, security.

Know More >>

What is a loan agreement?

A loan agreement is a legally binding contract between two or more parties to protect them. Its objective is to specify all the related information of the loan such as what is being loaned and how the borrower must repay the loan. A lender is a person who creates a simple loan agreement, and the burden of including all the agreement-related terms falls on the lending party.

This contract varies from simple negotiable relatives to wide-ranging borrowers. There is a loan agreement template that specifies what to give and what to expect in return. State guidelines control each type of agreement and the rules to repay it.

Types of the loan agreement are:

- Guarantee-based loan agreement- Requires security from the client side.

- Loans without security- This type of loan contract does not demand any security.

- Loan for education purposes- This is a loan agreement that permits the debtors to complete their studies.

- Loans for the individual- This is a personal loan contract that is for purchasing a home or automobile or arranging a holiday trip.

- A business loan agreement-It refers to a line of credit when the loan amount is used for business reasons.

Learn More >>

How the loan agreement is beneficial to the parties?

A specific loan agreement format is a promise to pay from borrower to lender once executed.

- Loan taking is a risky financial commitment. Therefore, a personal loan contract has been established and is beneficial to all participants to get profit.

- The agreement follows the basic rules such as the rate cost, the amount loaned, the security, the payment plan, overdraft payments and fines in case of any failure.

- A personal loan contract is a proof for a lender that the money was borrowed rather than given as a gift.

- Simple loan agreements are important documents when the borrowing or lending process is for a family member. This helps to avoid any conflicts about terms and conditions.

- In case the dispute gets to court, the loan agreement gives protection to both parties. It also allows the authorities to check if all the required circumstances are followed.

- If the loan contains interest, then one party can add an amortisation chart to the agreement for calculating the interest amount in each payment.

- The exact payment of the loan per month might be difficult. It becomes easy because it is specified in the loan agreements template.

All in all, a legal loan agreement format should be part of the procedure whenever you borrow or lend money. Moreover, it is safe for both parties.